Our adaptation, or not, to the factors threatening food and housing security

This is my brief analysis of the costs of a small basket of 14 grocery items falling within 9 categories that I collected in 2014, and again in 2024. I can summarise by telling you that our Canadian food dollar for this small sample is worth only 20% what it was in 2014. Read on and I will try to demonstrate how food costs spiraled upward, coupled with overall living costs, and provide a few reasons I think we have gotten to where we are.

You may be aware, if you live in Canada, of the recent investigations by legislative committees in Canada. Likewise, there are recent government reports on rising food costs in the United States. We all know that food, water, shelter and freedom from existential threats are musts for a healthy and productive society. Food security for many people is being threatened.

“From the CONVERSATION “Canada’s Competition Bureau recently announced it is launching an investigation into Loblaws and Sobeys for alleged anti-competitive conduct. This inquiry comes amid widespread concern over rising groceries costs across the country…, Philip A Loring from the University of Guelph and Ryan M. Katz-Rosene from the University of Ottawa write about their recent study on the science behind Canadian food price reports …If food prices are rising because they are starting to reflect the true social and ecological costs of production, we will need to enter a broader conversation about economic and livelihood reform to ensure that everyone can afford food.” [1]

In the US, similar concerns are being voiced about the threats to food security. The US General Accounting Office also provides recent analyses that point to significant increasing trends in food pricing [2].

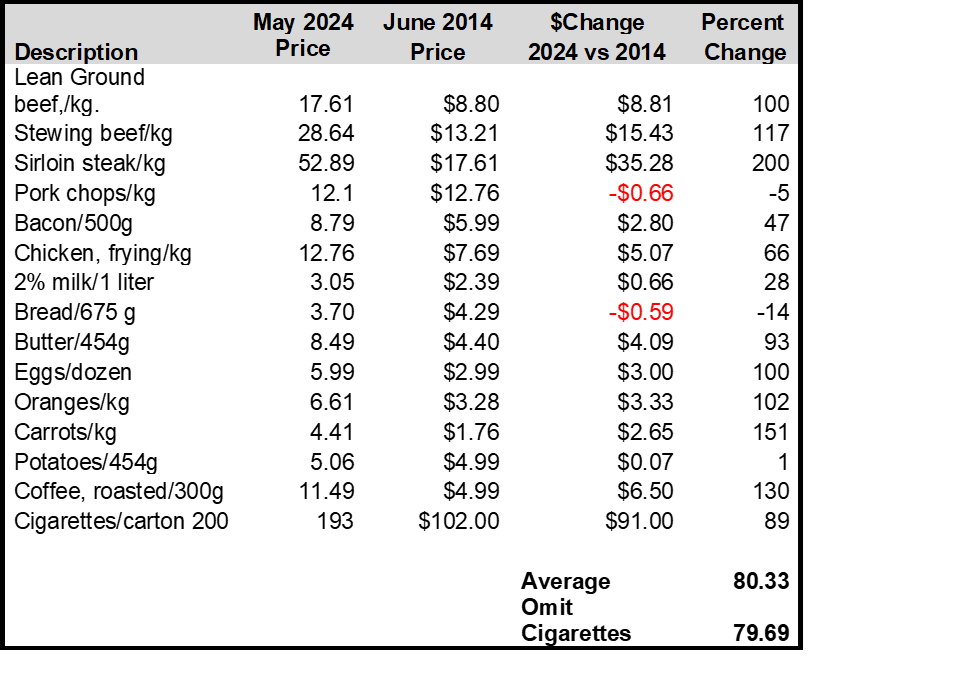

Data from 2014 and 2024 are summarised in this table; I’ve not smoked for many years, but people still do. I wanted to see how that cost might compete with money for food.

TABLE 1.

Source: the author; My data were collected during two opportunistic surveys on the Saanich Peninsula on Vancouver Island, BC, Canada, at two stores owned by local grocery chains. No rigorous statistical analyses are justified.

My family’s diet has changed considerably over the past 10 years. Red meat (beef) was never a large part but still dominates the cold meat displays. Fifty percent of the 14 items increased by >100%. The overall average increase was 80%. Fortunately 2% milk had increased by only ~28%, but other consumer staples like butter, eggs and coffee have doubled; I did not collect prices of tea or soft drinks. There is no doubt many sources of variability that make up these costs. If you shop you know there are usually several choices: bread for example. I chose whole wheat and the store brand as a mid-level price. And, if your a smoker in BC, and if you were to smoke a pack-of-20 per day, that sums up to ~$600/month! That could buy a few few bags of groceries even in today’s market.

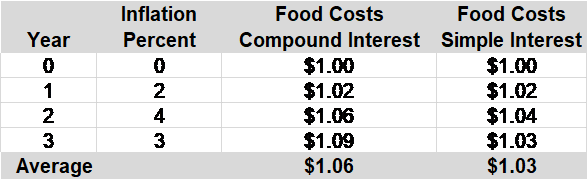

Listening to the daily news makes one think that inflation, now ~3% according to the Government of Canada, is linear. Think about it and you will realise that it is not unlike compounded interest, not simple interest.

I’ve provided an example in Table 2. I have tried to be realistic, i.e. food costs, or the Consumer Price Index (CPI) reported by the Government, may vary year to year. The take-home-message is:

regardless the value of the inflation rate, if it is positive it increases the prices over the previous year.

even thought inflation decreases in Year 3 food costs do not go down.

simple interest is only a consumer’s dream.

That is the power of compounding: great if your investments are compounding, bad if food costs are compounding!

TABLE 2.

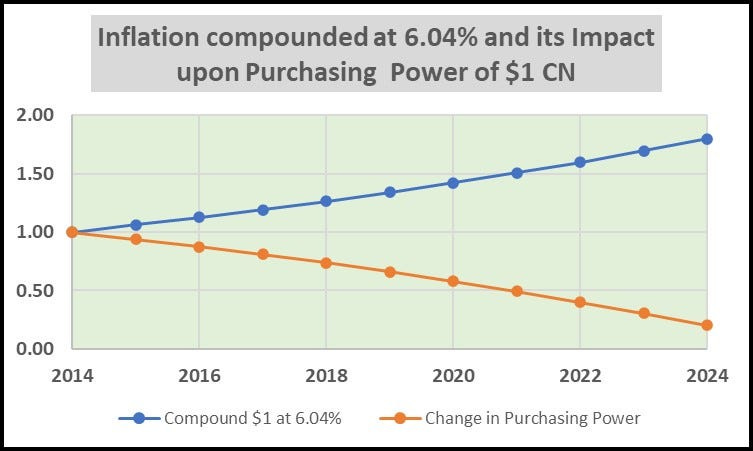

Let’s assume the that the small set of data in Table 1 are somehow representative and they have increased by 80%, what percent inflation must there be to produce that large a change. We can see the result, below. Over 10 years at ~6% inflation compounded between 2014 and 2024, we have arrived at an increase of 80% tacked onto a 2014 dollar. Conversely, what would buy $1 worth of goods in 2014, now in 2024, will only purchase 20 cents worth!

FIGURE 1. Source: Zack Florence

On our little patch of the globe house prices, increasing rents, and a growing population of “working poor”, and homeless, underline and put in bold print, the impacts of increasing numbers of citizens suffering food insecurity. The BC government recently raised the minimum wage to $17.40/hour. Whether that is a livable wage is problematic. We know what food prices have done, and housing is not much different. A 1-bedroom apartment on the Saanich Peninsula can vary from $1822/month upward to $2375/month, or more (April 2024). In the last 30 days rents in some areas have increased 9%, last year they were up 11%. In Victoria the rents are 43% higher than the national average.

Purchasing a modest 3 bedroom, 2 bath house is a whole different bowl of spaghetti. Location and condition are, of course big factors, but the deciding one is whether a potential buyer can get financing. Here’s a current, quick synopsis of the house/condo markets.

“The Multiple Listing Service® Home Price Index benchmark value for a single family home in the Victoria Core in April 2023 was $1,295,800. The benchmark value for the same home in April 2024 decreased by 0.9 per cent to $1,284,600, up from March’s value of $1,279,300. The MLS® HPI benchmark value for a condominium in the Victoria Core area in April 2023 was $564,000 while the benchmark value for the same condominium in April 2024 increased by 0.7 per cent to $567,800, up from the March value of $567,300.”

If your lender expects you to put up a 20% down payment that $200,000 per million. In BC you will add another several thousand as the buy must pay a “transfer tax”. Good luck! We must look no further as to why many young people never expect to the home owners in BC.

Why?

Here’s my take on what have been some of the major factors causing these exponential rising costs:

Earth, our only home, is warming at an exponential rate. That means increasing uncertainty, extreme events and interruptions of all sorts in food production.

COVID-19. In February 2020 the World Health Organization (WHO) announced a global pandemic. The “official end” was not until May 2023. In my life’s experience, I have never witnessed such global impacts upon health, society and the financial system like the one that continues because of COVID-19.

Our region on Vancouver Island, and BC in general, after the beginning of COVID-19 coupled with real estate rates that reached as low as 2%, produced a tsunami in house prices, speculation and overall distorted the whole economy. Rents and house prices have retreated very little.

Wars. Humans have this insatiable appetite for war. We know about the horrific impacts of the invasion of Ukraine by Russia’s Vladimir Putin, and the attacks last October of Hamas in Israel which has turned the Gaza strip into a blood bath and massive destruction. In Africa and the Middle East there are currently 45 active conflicts: https://geneva-academy.ch/galleries/today-s-armed-conflicts .

The only reason I am writing this from a house in the greater Victoria area is that we arrived almost 20 years ago. We would not be buying here today. Retirement obviously has its rewards. However, grocery shopping has obviously lost it’s “fun”: I’ll spare you the reader reflections on what things used to cost. As a male of our species I will say that I think that I have become a more thoughtful shopper! That’s a positive amongst all of this bad news.

Additional Sources

[2] www.gao.gov/assets/gao-23-105846.pdf

Take care of yourself and be on the lookout for any positives.

“Thank You” Eddie and Marilyn for your helpful comments.